Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. Typically, these non-marketable securities must be transacted privately or over the counter. It reveals how well a company can meet its debt and other obligations, and can be used to make comparisons between peers. The time value of money refers to the fact that money received in the present is worth more than the same amount received in the future, due to the earning power of the money. In the United States, GAAP does not recognize any increases in value of long-lived assets.

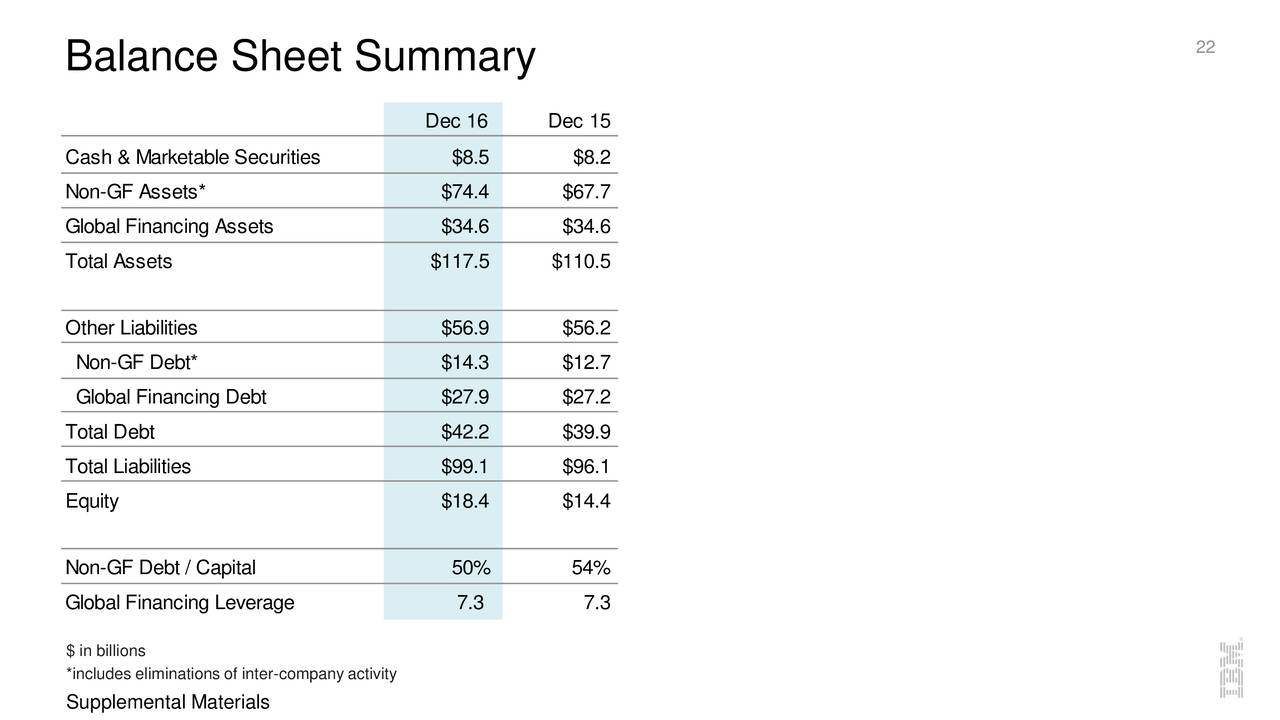

- The above illustrates the importance of marketable securities to businesses such as insurance companies, banks, and other financial companies.

- It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders.

- If a sudden need for cash emerges, the company can easily liquidate these securities.

- It is usually noted if marketable securities are not part of working capital.

Highly Liquid

Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital salvation army thrift store donation value guide is the sum of the equity that has been purchased at any price. Accounts within this segment are listed from top to bottom in order of their liquidity.

What Is the Most Common Example of a Marketable Security?

However, marketable securities run the risk of losing initial investment capital. There are numerous types of marketable securities, but stocks are the most common type of equity. For one thing, these securities are short-term liquid investments that can be quickly converted to cash when the business is in need of fast funds. For 2021, Airbnb had USD $6,067,438 in cash and cash equivalents, $2,255,038 in marketable securities, and its total current liabilities were $6,359,282. Liquidity ratios determine a company’s ability to meet short-term obligations, evaluating whether it has enough liquid assets to pay off short-term liabilities. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard.

How marketable securities are used in liquidity ratios

Quick assets are defined as securities that can be more easily converted into cash than current assets. The formula for the quick ratio is quick assets / current liabilities. This balance sheet also reports Apple’s liabilities and equity, each with its own section in the lower half of the report. The liabilities section is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets.

Current assets

This volatility can be emotionally difficult for some investors to tolerate, and it may also make it difficult for investors to achieve long-term investment goals. While marketable securities offer a range of benefits, there are also some downsides to consider. All marketable securities are subject to market risk, meaning that their value can fluctuate based on market conditions.

Where to find a company’s marketable securities

An investor who analyzes a company may wish to study the company’s announcements carefully. These announcements make specific cash commitments, such as dividend payments, before they are declared. Suppose that a company is low on cash and has all its balance tied up in marketable securities. Then, an investor may exclude the cash commitments that management announced from its marketable securities.

Apple invests in equities for the long term and focuses less on the gains or losses from its portfolio. Short-term liquidities or marketable securities have many different classifications for accounting based on the purpose of their purchase. Therefore, Prudential uses its investments to drive more income than Microsoft. And because of that need, the company invests in a wide range of securities, primarily debt securities.

That portion of marketable securities is earmarked and spent on something other than paying off current liabilities. Under this classification, marketable securities must satisfy two conditions. The second condition is that those who purchase marketable securities must intend to convert them when in need of cash. In other words, a note purchased with short-term goals in mind is much more marketable than an identical note bought with long-term goals in mind. The most reliable liquid securities fall in the money market category.

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios. Under this predominant definition, marketable securities are also called short-term investments.

Leave a Reply