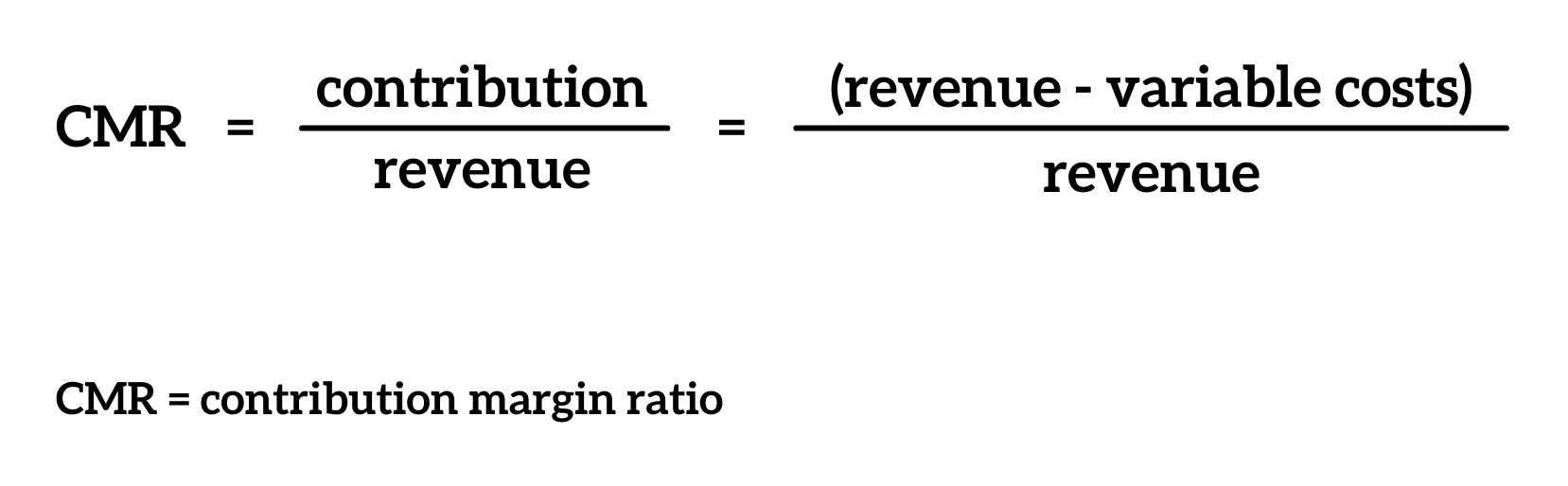

Because this figure is usually expressed as a percentage, we’d then divide the contribution margin by the revenue to get the ratio of 0.44. To get the contribution margin, you subtract these costs from the product’s revenue. Quickly surface insights, drive strategic decisions, and help the business stay on track. This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set.

Which of these is most important for your financial advisor to have?

- To calculate the contribution margin, you need more detailed financial data to calculate EBIT.

- Accordingly, you need to fill in the actual units of goods sold for a particular period in the past.

- Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

- Regardless of how much it is used and how many units are sold, its cost remains the same.

The gross sales revenue refers to the total amount your business realizes from the sale of goods or services. That is it does not include any what is trade discount journal entry examples calculator deductions like sales return and allowances. Direct Costs are the costs that can be directly identified or allocated to your products.

What Is the Difference Between Contribution Margin and Profit Margin?

For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential. While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service. The contribution margin (CM) is the profit generated once variable costs have been deducted from revenue. Where C is the contribution margin, R is the total revenue, and V represents variable costs. Variable costs (or expenses) are any costs that do not remain consistent.

Fixed Cost vs. Variable Cost

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

The contribution format income margin is essential for understanding the financial performance of individual products or services and is used to make informed decisions about pricing, production, and cost management. If you’re serious about safeguarding your business’s finances, you need to get into the granular details of your profitability—and that means producing quality contribution margin income statements. Management uses the contribution margin in several different forms to production and pricing decisions within the business.

Advantages of a Contribution Margin Income Statement

Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows. Thus, you need to make sure that the contribution margin covers your fixed cost and the target income you want to achieve. Contribution margin calculation is one of the important methods to evaluate, manage, and plan your company’s profitability. Further, the contribution margin formula provides results that help you in taking short-term decisions. Interpreting these numbers requires a nuanced understanding of the business’s operational landscape. Sharp fluctuations in contribution margin or a contribution margin ratio divergent from industry standards could signal the need for a strategic pivot.

EBITDA focuses on operating expenses and removes the effects of financing, accounting, and tax decisions. A high contribution margin cushions the fall from unexpected costs and dips in sales. That’s why any business worth its salt will look to improve its margins wherever possible. Further, it is impossible for you to determine the number of units that you must sell to cover all your costs or generate profit.

The following examples explain the difference between traditional income statement and variable costing income statement. A traditional income statement is prepared under a traditional absorption costing (full costing) system and is used by both external parties and internal management. Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold. The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). However, the contribution margin facilitates product-level margin analysis on a per-unit basis, contrary to analyzing profitability on a consolidated basis in which all products are grouped together.

Then, all fixed expenses are subtracted to arrive at the net profit or net loss for the period. Thus, the arrangement of expenses in the income statement corresponds to the nature of the expenses. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000. This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced. Such fixed costs are not considered in the contribution margin calculations. On the other hand, variable costs are costs that depend on the amount of goods and services a business produces.

Accordingly, in the Dobson Books Company example, the contribution margin ratio was as follows. This is because the contribution margin ratio lets you know the proportion of profit that your business generates at a given level of output. So, you should produce those goods that generate a high contribution margin. As a result, a high contribution margin would help you in covering the fixed costs of your business. Contribution margin analysis is a valuable tool for monitoring financial health over time. By tracking changes in contribution margins alongside key performance indicators, businesses can quickly identify trends, spot emerging challenges, and capitalize on opportunities.

Leave a Reply