COGS only considers direct materials and labor that go into the finished product, whereas contribution margin also considers indirect costs. For instance, Nike has hundreds of different shoe designs, all with different contribution margins. Putting these into a traditional income statement illustrates the bigger picture of which lines are doing better than others, or if any shoes need to be discontinued. A low margin typically means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future.

How can Taxfyle help?

The more it produces in a given month, the more raw materials it requires. Likewise, a cafe owner needs things like coffee and pastries to sell to visitors. The more customers she serves, the more food and beverages she must buy. These costs would be included when calculating the contribution margin. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.

Example 2 – multi product company:

It considers the sales revenue of a product minus the variable costs (i.e., costs that change depending on how much you sell), like materials and sales commissions. To calculate the contribution margin, you take the sales revenue (that’s all the money you get from selling products) and subtract the variable costs (the costs that change based on how much you sell). This number is super important because it shows how much money is available to cover the fixed costs (like rent for the lemonade stand) and hopefully leave some profit. It’s like if you sold $100 worth of lemonade and it cost you $50 for sugar and cups, your contribution margin would be $50. This $50 is what you have left to pay for things that don’t change in cost, like your lemonade stand’s spot on the sidewalk, and then to keep as profit. The concept of margin is key to understanding how businesses make money.

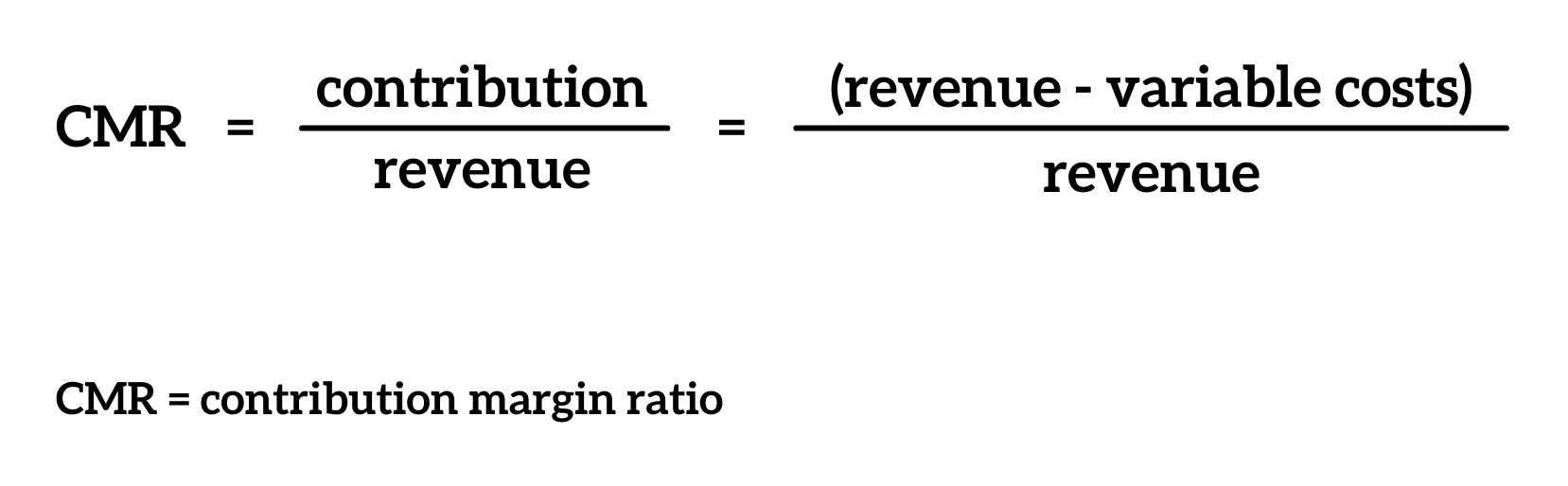

Calculating Contribution Margin Ratio

Net profit is making more than you spent in the period, and net loss is spending more than you made. Converted into a percentage, this leaves the beauty company with a 44% contribution margin on its skincare product. You don’t need to spend this money what is the weighted average contribution margin in break to create the product, but it is still included in the cost of making a sale. The following are the disadvantages of the contribution margin analysis. Thus, to arrive at the net sales of your business, you need to use the following formula.

Why You Can Trust Finance Strategists

More than 488 units results in a profit, and 486 units or less result in a loss. Discover books, articles, webinars, and more to grow your finance career and skills. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

How do you calculate EBIT and EBITDA on an income statement?

- Investors examine contribution margins to determine if a company is using its revenue effectively.

- Direct Costs are the costs that can be directly identified or allocated to your products.

- In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights.

- Thus, to arrive at the net sales of your business, you need to use the following formula.

- Get instant access to video lessons taught by experienced investment bankers.

They’re all about figuring out not just how much money a company makes, but how it makes that money and what it means for the future. They’re essential for understanding the health and performance of a business, guiding decision making, and planning for growth. This holistic approach to financial decision-making helps finance teams align strategies with business objectives, maximizing profitability and driving sustainable growth. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Finding an accountant to manage your bookkeeping and file taxes is a big decision. Set your business up for success with our free small business tax calculator. Free up time in your firm all year by contracting monthly bookkeeping tasks to our platform.

When comparing the two statements, take note of what changed and what remained the same from April to May. The contribution margin ratio refers to the difference between your sales and variable expenses expressed as a percentage. That is, this ratio calculates the percentage of the contribution margin compared to your company’s net sales. Fixed costs are the costs that do not change with the change in the level of output.

This ratio shows how much money from sales is available to cover fixed costs, like rent for the lemonade stand, and still have profit left over. To find this, we subtract the variable production costs from sales and then divide by the sales again. It’s important for the CEO and others to know this so they can make smart decisions about prices and costs.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. As of Year 0, the first year of our projections, our hypothetical company has the following financials. One common misconception pertains to the difference between the CM and the gross margin (GM). Investopedia contributors come from a range of backgrounds, and over 25 years there have been thousands of expert writers and editors who have contributed.

Leave a Reply