Without a project plan or product roadmap, it’s hard to make sure all stakeholders and teams are on the same page.

Product cost vs. period cost

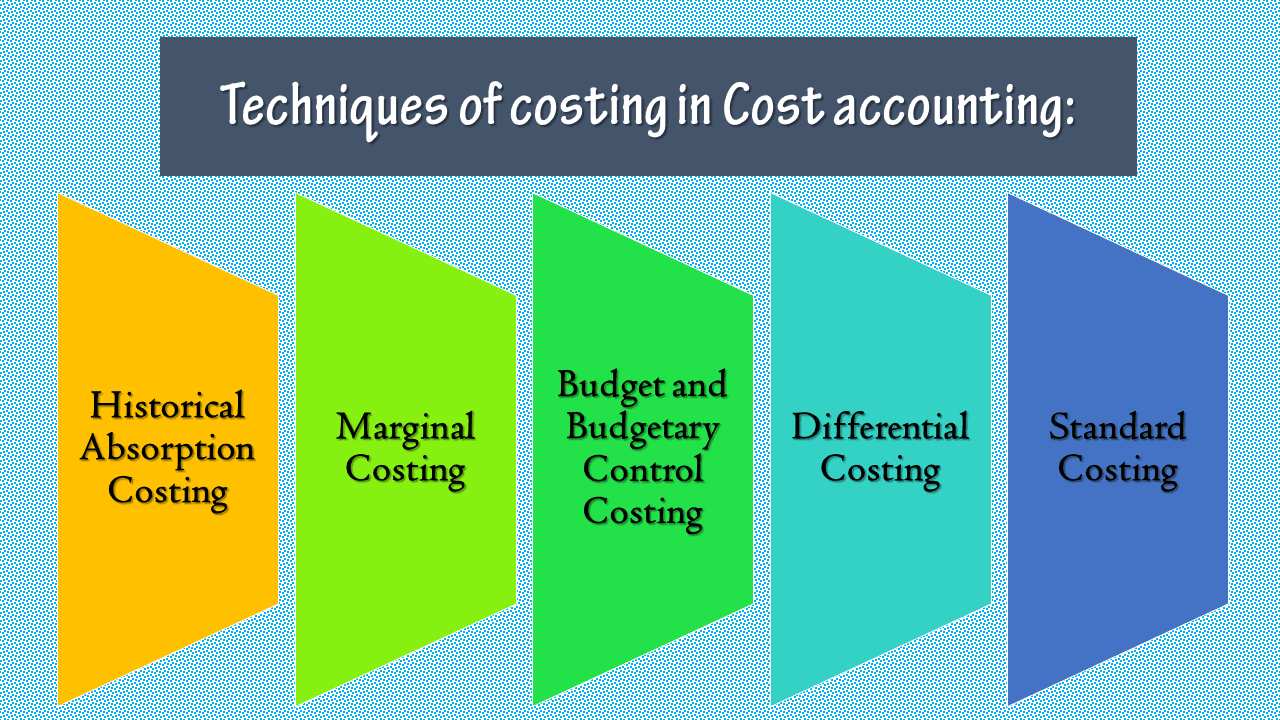

Whereas Activity-Based Costing takes into account various cost drivers and assigns different rates to different activities in order to more accurately assign costs. Costing methods in manufacturing, also known as production costing methods, are techniques for determining how much it costs to produce finished goods. Some methods can be used to determine total manufacturing costs, while others focus on evaluating specific processes, materials, or labour. It helps control costs by identifying areas of inefficiency, reducing waste, and optimizing resource utilization.

What are the different types of cost drivers under ABC?

Marginal costing could reveal that 1,500 units can be produced at the same time without increasing your fixed costs. Target costing is an accounting method that’s calculated based on forecasts, rather than historic data. Research and expected material costs are used to estimate targets for pricing, margins, and product costs in advance of production. Like inventory costing, there are many production costing methods you can use to determine manufacturing costs. Food costs percentage consists of dividing the price of goods sold and the profit/sale generated by these products.

Is financial aid available?

- Target costing starts with a target cost based on market prices and then finds ways to meet it.

- His hands-on experience with thousands of clients and involvement in product development has made him a trusted advisor in the manufacturing software industry.

- Under absorption costing, no distinction is made between fixed costs and variable costs.

- Imagine your business sells 1,000 units per month and total production costs equate to $3 per unit.

Stay competitive while also making sure that your pricing strategy supports your profitability. Understanding your business priorities will guide you to the right costing method. For example, if you want to minimize costs, you may benefit from the standard costing method because it depreciation tax shield calculation emphasizes cost control. But if you’re focused on improving pricing, it may be better to choose target costing because it aligns costs with market prices. For example, a toy manufacturer may use marginal costing to decide whether or not to accept a special order at a lower price.

The method by which a manufacturer establishes that standard, however, is probably the biggest drawback to standard costing. Employees will become discouraged if your organization sets standards that are essentially impossible to meet, which could have a detrimental effect on output. In contrast, if your standards are too lax, workers might follow them, which immediately leads to lost productivity and, as a result, poorer efficiency and profitability. One that comes up regularly is how much time and money it actually takes to establish and maintain the standards that are allocated to production activities (i.e. engineering, materials, and overhead). Another is that once a standard is put in place, it always gets slightly out of date.

What is product cost and how to calculate (with example)

Although there are several different ways to approach product costing, you can follow these seven basic steps in any situation. Target costing is a method used to ensure that products are designed and priced to meet customer needs. Having a clear overview of your processes and related costs is vital for any business. Learn how cloud inventory software can help you to keep your finger on the pulse. The disadvantage of job costing is that it can be time-consuming since you need to track and allocate all the different expenses accordingly. The disadvantages of standard costing are that it can be inaccurate if circumstances change significantly from the time the business established the standards.

You will learn what cost accounting is and how cost accounting relates to corporate accounting. Thereafter, you will get familiar with some basic cost terms that are essential for cost accountants. Finally, we will introduce you to a framework that distinguishes three sub-systems of cost accounting.

Deskera ERP is a complete solution that allows you to manage suppliers, track supply chain activity in real time, and streamline a range of other company functions. The condition of your inventory has a direct impact on production planning, people and machinery use, and capacity utilization. Fixed overheads- Such as rent, are expenses that are constant regardless of the volume of output. There truly is no incorrect choice if it makes sense for your organization when choosing the costing approach or model that works best for a manufacturer.

With reliable product costing data, businesses can make strategic decisions regarding product mix, production processes, sourcing options, and resource allocation. This empowers them to adapt to changing market dynamics, identify growth opportunities, and optimize their operations for long-term success. Activity-based costing (ABC) sets overhead costs based on the specific activities that cause those costs. It’s good for manufacturers that produce a wide range of products and also have complex processes. This method helps you identify cost drivers, but ironically, it can be expensive to implement. Standard costing is a method where businesses set expected costs for materials, labor, and overhead before production begins.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Leave a Reply